Stay Deal Ready: Benefits of Virtual Data Rooms for Startups

Managing confidentiality, organization, and smooth collaboration can be a daunting task for startups. Luckily, there is a secure digital solution at hand. Virtual data rooms (VDRs) transform the way startups engage with potential investors regarding confidential matters.

This article delves into the benefits that virtual data rooms offer to startups. We discuss the critical documents to include in an investor data room and those to avoid, and we help you to choose the ideal data room provider for startup requirements.

Understanding Virtual Data Rooms for Startups

A virtual data room (VDR) acts as a highly secure online repository for storing private documents. It ensures a protected space for sharing crucial information with potential investors, partners, or purchasers. A well-structured VDR can significantly speed up fundraising, due diligence processes, and collaborative projects within the startup community.

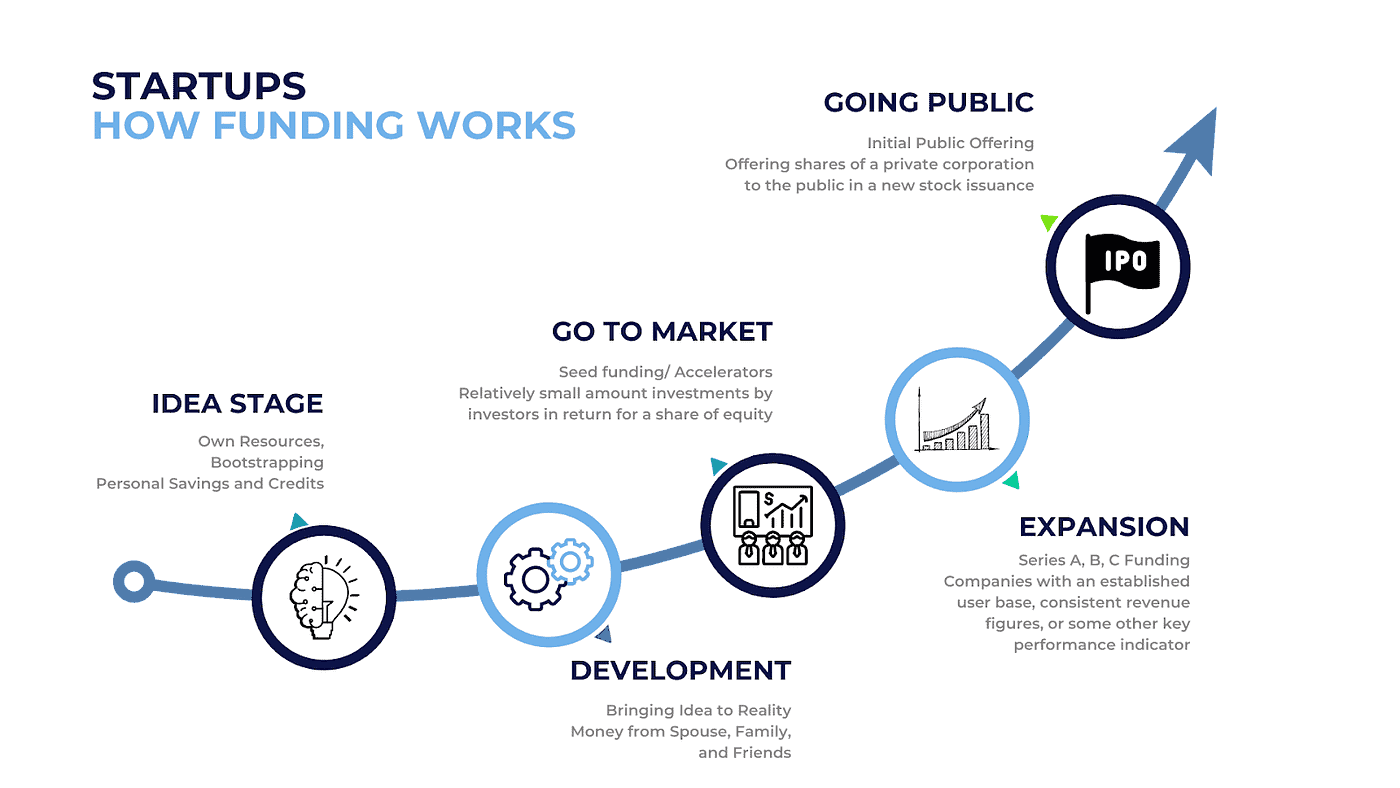

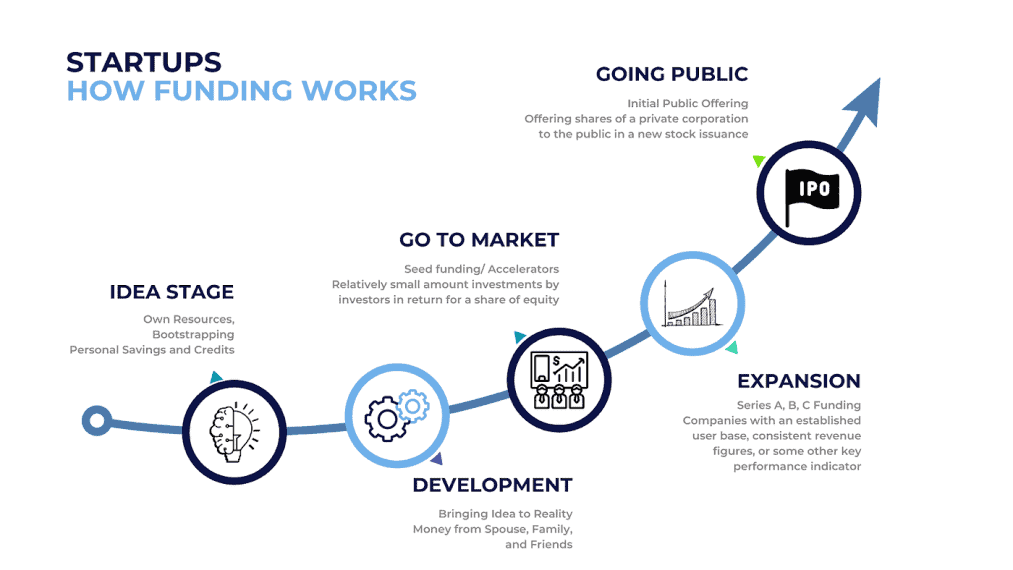

Using a data room for sharing sensitive details with potential backers ensures maximum privacy and convenience. Though often underappreciated, having a fundraising data room significantly aids in persuading investors about your business proposition. It streamlines the decision-making process for startups at all levels, establishing trust and garnering support for your enterprise.

The Necessity of Virtual Data Rooms for Startups

Startups are not just about groundbreaking ideas but convincing investors of the worth of these ideas. Let’s look at how data room software is advantageous for startups.

- Data Security: Virtual data rooms offer robust security measures for sensitive data, including encryption, multi-factor authentication, and role-based access controls.

- Enhanced Organization: They facilitate efficient and tidy document management and allow for advanced and partial text searches to quickly locate files.

- Faster Transactions: VDRs enable instantaneous document sharing and access, centralizing documents for streamlined and quick transactions.

- Professional Image: A systematically organized VDR shows a startup’s serious business approach and commitment to transparency.

- Better Engagement: Real-time analytics provide detailed insights, enabling targeted follow-ups and more effective engagement strategies.

What to Include in an Investor Data Room

Crafting the content for your investor data room should be done carefully. It should neither overwhelm nor lack essential information, aiming to expedite fundraising. The investor data room reflects your startup.

Documents crucial for a successful funding campaign include:

- Pitch Deck: Offers a succinct, engaging summary of your business, highlighting its unique selling points, market potential, and growth plan.

- Team Resumes: Present your team’s expertise and achievements, emphasizing any industry-relevant experience or skills.

- Business Plan: Serves as a roadmap for your startup, detailing your business model, market strategy, and financial forecasts.

- Marketing Plan: Outlines your strategy for customer acquisition and retention, supported by market analysis and KPIs.

- Action Plan: Lists short and long-term objectives and the strategies to achieve them, showcasing your proactive and organized approach.

- Legal Contracts: Include vital agreements that reflect your startup’s legal standing and obligations.

- Financial Statements: Provide a comprehensive view of your financial health, crucial for investor confidence.

- Intellectual Property: Document any patents, trademarks, or copyrights, underscoring the protection of your competitive edge.

What to Exclude from an Investor Data Room

Controlling the narrative is key during fundraising. Ensure the investor data room contains only pertinent information, avoiding anything irrelevant or potentially distracting. Exercise caution with sensitive data and tailor the content to the investor’s journey stage.

Key Points to Remember

- Virtual data rooms enable secure and swift sharing of sensitive data for startups.

- Benefits include enhanced data security, organization, quicker transactions, a professional company image, and detailed engagement analytics.

- Avoid including unnecessary information and customize the data room content according to the investor’s specific needs.

- Select a virtual data room that aligns with your startup’s requirements, desired software functionalities, and security standards.

- Evaluating independent reviews is crucial before setting up a virtual data room for your startup.

An article by Archeiothiki VDR Experts